How Fear of Missing Out Is Distorting Healthcare Deal making and Practice Valuations

The Hidden Force Behind Today’s Deal Frenzy

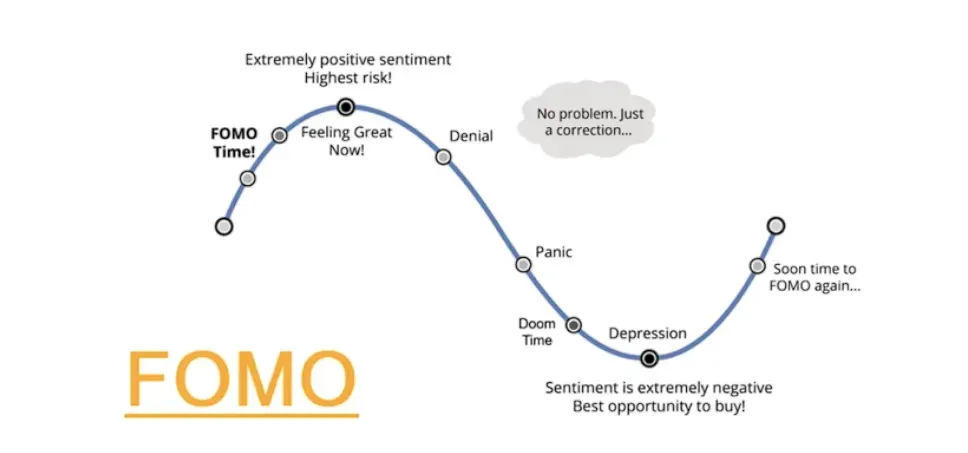

In today’s healthcare M&A environment, FOMO — the fear of missing out — has become a quiet but powerful market driver– influencing how private equity groups, health systems, and physician owners evaluate deals — often pushing decisions faster and higher than fundamentals can justify.

Having completed more than 7,000 practice valuations across 100+ healthcare organizations, I’ve seen this cycle repeat: when deal volume surges, discipline slips, and emotion takes the wheel.

Buyers: Racing the Clock

Private equity firms, MSOs, and health systems are competing intensely to secure “platform” practices – With quality assets scarce, diligence windows are shrinking and valuations are inflating – not always because of improved fundamentals, but because no one wants to be the last to buy in.This race mentality often produces:

- Overpayment and integration challenges

- Unrealized synergies post-acquisition

- Pressure on future returns and fund performance

Sellers: Following the Herd

For physicians, FOMO takes a different form –if they don’t sell now, they’ll miss their chance entirely –rushing to market before optimizing operations, chosingmisaligned buyers, trading long-term autonomy for a quick payout, and too often, the regret that follows it.

When FOMO Meets Valuation

Valuation is meant to be a stabilizing force — an objective analysis of performance, risk, and growth potential- but when FOMO enters the equation, perception replaces principle.

- Buyers rationalize overpayment as “strategic positioning.”

- Sellers assume current market peaks are permanent.

- Both lose focus on fit, timing, and sustainability.

In short: emotion starts to price the deal instead of economics.

A Better Path Forward

The solution isn’t to avoid deals — it’s to ground them in preparation and perspective.

For Sellers:

- Take time to improve efficiency and earnings before going to market.

- Understand your post-close objectives, not just the multiples your peers achieved.

For Buyers:

- Maintain valuation discipline.

- Model realistic post-close performance and integration costs.

For Both:

- Prioritize strategic and cultural alignment.

- Let fundamentals — not fear — guide your timing.

Conclusion: Confidence Over Fear

In healthcare acquisitions, discipline outlasts hype.The best transactions are built on confidence in fit, readiness, and value — not fear of missing out.

About the Author

Brian King is a valuation expert with more than 7,000 practice valuations completed for hospitals, health systems, and physician enterprises across the U.S. Healthscope, Inc. focuses on fair market value, transaction readiness, and strategic advisory for medical practice integrations.

📩Connect with me on LinkedIn to discuss valuation strategy, FMV trends, or physician practice transactions.